Why Offshore Investment Is an Effective Way to Protect Your Retired Life Finances

Why Offshore Investment Is an Effective Way to Protect Your Retired Life Finances

Blog Article

All About Offshore Financial Investment: Insights Into Its Considerations and advantages

Offshore investment has ended up being a significantly pertinent subject for people looking for to expand their profiles and boost economic protection. As we discover the subtleties of overseas financial investment, it comes to be obvious that educated decision-making is crucial for optimizing its prospective benefits while reducing fundamental risks.

Understanding Offshore Investment

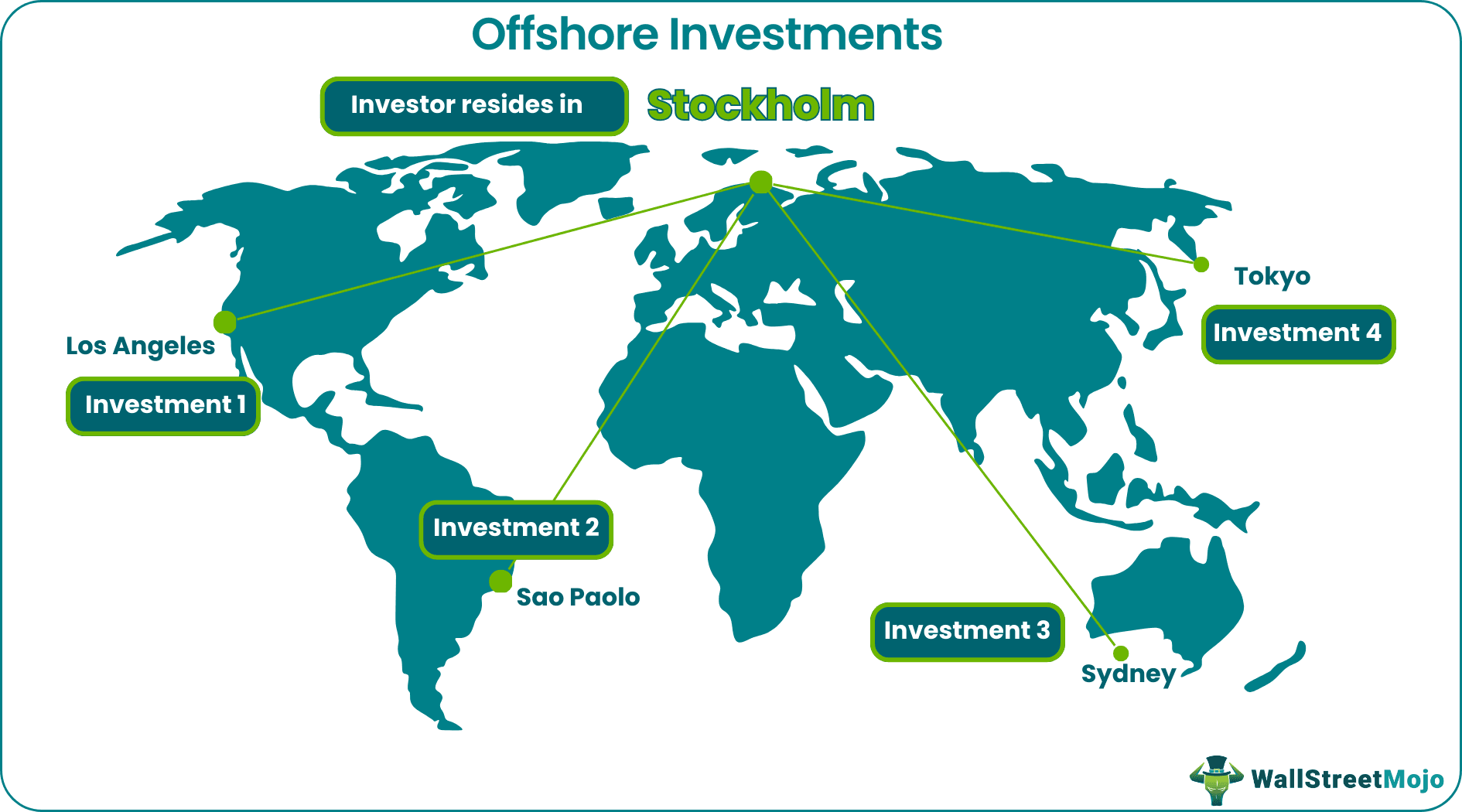

In the world of international money, comprehending offshore investment is vital for entities and people looking for to maximize their economic profiles. Offshore investment refers to the positioning of assets in banks outside one's country of residence. This technique is usually made use of to accomplish various economic objectives, including diversity, possession security, and prospective tax advantages.

Offshore investments can include a large range of monetary instruments, including stocks, bonds, shared funds, and actual estate. Capitalists might select to develop accounts in territories understood for their beneficial regulative environments, privacy regulations, and economic security.

It is vital to recognize that offshore financial investment is not inherently identified with tax evasion or immoral activities; instead, it serves reputable functions for several financiers. The inspirations for taking part in overseas investment can vary widely-- from seeking greater returns in developed markets to securing assets from political or financial instability in one's home country.

However, prospective capitalists must likewise be mindful of the intricacies involved, such as compliance with worldwide laws, the necessity of due diligence, and comprehending the lawful effects of offshore accounts. In general, a thorough understanding of overseas financial investment is vital for making educated monetary decisions.

Secret Advantages of Offshore Financial Investment

Offshore investment offers several key benefits that can boost a financier's monetary technique. This can considerably enhance overall returns on financial investments.

In addition, overseas financial investments usually give accessibility to a wider variety of investment opportunities. Capitalists can expand their portfolios with assets that might not be easily available in their home nations, consisting of worldwide supplies, realty, and specialized funds. This diversity can decrease risk and boost returns.

Furthermore, offshore investments can help with estate preparation. They enable financiers to structure their properties in a manner that lessens estate tax obligations and ensures a smoother transfer of riches to successors.

Usual Risks and Challenges

Buying overseas markets can provide numerous risks and obstacles that require cautious factor to consider. One substantial risk is market volatility, as offshore investments might undergo variations that can affect returns substantially. Investors should likewise know geopolitical instability, which can interfere with markets and influence financial investment efficiency.

Another challenge is currency risk. Offshore investments typically include deals in foreign currencies, and undesirable currency exchange rate motions can wear down earnings or rise losses. Offshore Investment. In addition, minimal accessibility to reliable details concerning overseas markets can prevent enlightened decision-making, causing possible bad moves

Lack of regulatory oversight in some offshore jurisdictions can additionally posture hazards. Capitalists might locate themselves in atmospheres where financier protection is minimal, increasing the threat of scams or mismanagement. Moreover, varying monetary practices and social mindsets toward investment can make complex the financial investment procedure.

Regulative and legal Factors to consider

While navigating the complexities of overseas investments, understanding the regulatory and lawful landscape is important for ensuring and guarding possessions compliance. Offshore financial investments are commonly subject to a wide variety of legislations and regulations, both in the capitalist's home country and the territory where the investment is made. As a result, it is important to perform complete due diligence to comprehend the tax obligation check my site ramifications, reporting needs, and any lawful obligations that may arise.

Regulatory structures can differ considerably in between territories, affecting every little thing from tax to resources requirements for international investors. Some nations might provide desirable tax obligation programs, while others enforce rigorous regulations that could prevent financial investment. Furthermore, international contracts, such as FATCA (Foreign Account Tax Obligation Compliance Act), might obligate capitalists to report offshore holdings, raising the need for openness.

Investors should likewise understand anti-money laundering (AML) and know-your-customer (KYC) policies, which need banks to confirm the identity of their clients. Non-compliance can result in severe penalties, including fines and restrictions on investment tasks. Involving with legal experts specializing in international financial investment regulation is critical to browse this complex landscape efficiently.

Making Educated Decisions

A strategic strategy is necessary for making informed choices in the realm of overseas financial investments. Understanding the intricacies included calls for complete research study and evaluation of different factors, consisting of market trends, tax obligation implications, and lawful frameworks. Financiers must evaluate their risk resistance and investment goals, ensuring positioning check over here with the unique attributes of offshore chances.

Looking at the regulatory atmosphere in the chosen jurisdiction is crucial, as it can substantially influence the safety and security and profitability of investments. Additionally, staying abreast of geopolitical advancements and economic conditions can supply valuable insights that his response educate investment techniques.

Engaging with specialists that focus on offshore financial investments can likewise boost decision-making. Offshore Investment. Their proficiency can direct investors through the complexities of international markets, aiding to recognize rewarding chances and potential challenges

Inevitably, notified decision-making in offshore investments pivots on a versatile understanding of the landscape, a clear articulation of individual purposes, and a dedication to ongoing education and learning and adjustment in a dynamic global setting.

Final Thought

To conclude, offshore financial investment provides significant benefits such as tax optimization, asset defense, and access to global markets. It is vital to acknowledge the affiliated dangers, including market volatility and governing difficulties. An extensive understanding of the legal landscape and attentive study is crucial for effective navigation of this facility field. By addressing these factors to consider, investors can successfully harness the benefits of offshore financial investments while alleviating potential disadvantages, inevitably resulting in educated and strategic monetary choices.

Offshore investment supplies numerous crucial advantages that can boost a capitalist's monetary approach.Additionally, offshore investments typically give accessibility to a wider variety of financial investment possibilities. Varying monetary practices and social attitudes toward investment can complicate the financial investment process.

Report this page